Decentralized Marketplaces: The Future of Peer-to-Peer Trading

Table of Content

Introduction

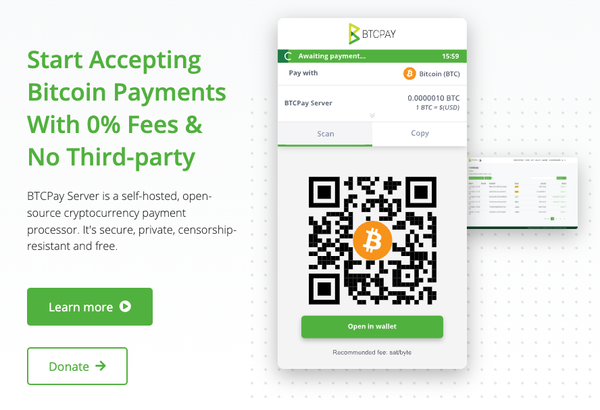

The rise of blockchain technology has revolutionized traditional commerce, giving birth to decentralized marketplaces that eliminate intermediaries and promote transparency. Unlike centralized platforms like Amazon and eBay, decentralized marketplaces operate on blockchain networks, enabling direct peer-to-peer transactions without the need for third-party oversight.

These platforms provide greater security, lower transaction costs, and improved privacy, making them an attractive option for buyers and sellers worldwide. With the increasing adoption of cryptocurrencies and blockchain technology, decentralized marketplaces are reshaping digital commerce.

This article explores the concept, benefits, challenges, and use cases of decentralized marketplaces, along with key industry players and their future impact.

What Are Decentralized Marketplaces?

Definition and Concept

A decentralized marketplace is a blockchain-based platform that facilitates peer-to-peer (P2P) transactions without relying on a central authority. These platforms use smart contracts to automate transactions and ensure security, transparency, and immutability.

How They Work

✔ Users list products or services directly on the blockchain.

✔ Smart contracts facilitate transactions without intermediaries.

✔ Payments are made using cryptocurrencies like Bitcoin or Ethereum.

✔ Ownership and transaction history are stored on the blockchain, preventing fraud.

Example: OpenBazaar, a decentralized marketplace, allows users to trade goods and services directly without relying on a central authority.

Benefits of Decentralized Marketplaces

1. Lower Transaction Fees

✔ No middlemen, resulting in reduced transaction costs compared to centralized platforms.

2. Increased Privacy and Security

✔ Transactions are pseudonymous and encrypted, protecting user identities.

3. Transparency and Trust

✔ Immutable blockchain records prevent fraud and provide a transparent transaction history.

4. Global Accessibility

✔ Users from anywhere in the world can participate without regional restrictions.

5. Resistance to Censorship

✔ No central authority can control or manipulate transactions.

Example: Platforms like immediate 4 keflex provide trading insights and security features for users in decentralized commerce.

Challenges of Decentralized Marketplaces

1. Limited User Adoption

✔ Many users are unfamiliar with blockchain-based trading, slowing mass adoption.

2. Scalability Issues

✔ Some decentralized platforms struggle with high transaction fees and slow processing times due to network congestion.

3. Lack of Consumer Protection

✔ Unlike centralized platforms, decentralized marketplaces do not offer refunds or dispute resolution services.

4. Price Volatility in Crypto Payments

✔ Payment methods rely on cryptocurrencies, which can experience significant price fluctuations.

5. Regulatory Uncertainty

✔ Governments are still developing regulations for blockchain-based commerce, creating potential legal risks.

Solution: Platforms like immediate 4 keflex help traders navigate regulatory challenges and market risks in decentralized trading.

Popular Decentralized Marketplaces

1. OpenBazaar

✔ A decentralized, peer-to-peer e-commerce platform for buying and selling goods using Bitcoin.

2. Rarible

✔ A decentralized NFT marketplace where artists and creators can mint and trade digital assets.

3. Origin Protocol

✔ A platform for creating decentralized e-commerce stores using blockchain technology.

4. Particl

✔ A privacy-focused decentralized marketplace offering secure transactions and encrypted messaging.

FAQ: Decentralized Marketplaces

1. How do decentralized marketplaces differ from traditional e-commerce?

✔ They eliminate central authorities, providing direct peer-to-peer trading with greater transparency and lower fees.

2. Are decentralized marketplaces safe to use?

✔ Yes. Blockchain technology ensures secure, encrypted, and tamper-proof transactions.

3. What are the risks of using decentralized marketplaces?

✔ Risks include lack of buyer protection, cryptocurrency volatility, and regulatory challenges.

4. Can I use fiat currency in decentralized marketplaces?

✔ Most platforms require cryptocurrency payments, though some are integrating fiat on-ramps.

5. How do smart contracts facilitate decentralized transactions?

✔ Smart contracts automate transactions, ensuring trustless execution without intermediaries.

6. What are the best decentralized marketplaces in 2024?

✔ Platforms like OpenBazaar, Rarible, and Origin Protocol are leading the market.

7. Is it possible to trade NFTs in decentralized marketplaces?

✔ Yes. NFT marketplaces like Rarible and OpenSea enable peer-to-peer digital asset trading.

8. How can I protect myself from scams on decentralized marketplaces?

✔ Use verified smart contracts, check seller reputations, and trade on trusted platforms.

Conclusion

Decentralized marketplaces are redefining global commerce by offering secure, transparent, and low-cost peer-to-peer trading. By eliminating intermediaries, these platforms empower users with greater control over their transactions while ensuring enhanced security and efficiency.

While challenges like regulatory uncertainty, crypto volatility, and limited adoption remain, the increasing interest in blockchain commerce suggests strong growth potential. As technology evolves, decentralized marketplaces could become mainstream alternatives to traditional e-commerce.

For those seeking secure and efficient decentralized trading platforms, immediate 4 keflex provides expert insights and resources to navigate the growing landscape of blockchain-based commerce. 🚀