Healthcare Industry and Stock Market Dynamics: A Comprehensive Guide

Table of Content

Although it is not often the first choice for investment, it is worth thinking twice about it. These stocks are worth considering first and foremost for their stability. There are also few healthcare companies on the market that pay their dividends monthly.

This can also be of interest to some investors. Diversifying your investment portfolio with these stocks might just be the wise decision you were waiting for a while.

However, it is a complex sector. It is influenced by multiple factors: regulatory changes, technological advancements, and demographic shifts. That's why it is very important to be well informed and to have good investment strategies. They are necessary to navigate these intricacies effectively, and with some confidence.

Inside the Healthcare Landscape

Having a good source of information on stock opportunities is everything! This is the only way you can make informed decisions and smart investments. Investing in healthcare means being able to follow the stock market dynamics in that area. Familiarize yourself with key segments in the industry. Each is with unique characteristics and market dynamics:

Pharmaceuticals:

This involves companies that research, develop, produce, and market therapeutic drugs. They are characterized by high R&D costs, but also potentially significant returns on successful products.

Biotechnology:

These firms use biological processes to develop health-related products and technologies. They are often at the forefront of medical science. Thanks to the innovations in this field, healthcare services are improved. This also means that patient care is progressing and that the quality of medical care is at it's peak.

Healthcare Services:

These include hospitals, clinics, and other facilities that provide direct patient care. They also provide ancillary services: laboratory testing, imaging, and rehabilitation.

Medical Devices:

These are the companies that design and manufacture devices used in medical procedures. They are used in diagnostics and treatment as well. Innovations here greatly impact patient outcomes and healthcare efficiency.

Recent trends that are shaping the healthcare industry include many different technological advancements. Telemedicine, wearable health devices, and AI are improving patient care and operational efficiency. All these advancements guarantee higher chances of positive outcomes. Patient care has always been at the core of the medical profession.

The growing elderly population drives demand for healthcare services. People live longer, but at the same time this also means that they spend more time in need of medical services. It is particularly true for patients with chronic diseases. Policy and regulatory shifts impact drug approvals and healthcare funding.

In the pandemics environment, every online service had its peak moment, and some were about to be born. Many of them prevailed and made significant changes in the way we do things. This is especially true for healthcare.

Stock Market Dynamics and the Healthcare Sector

Healthcare stocks are typically viewed as a safe haven during economic downturns. It is thanks to the essential nature of the services and products they provide.

Historically, these stocks have shown resilience and steady growth. They are often outperforming other sectors during periods of market volatility. However, their performance can vary widely depending on the specific segment and company in question.

Several factors influence the performance of healthcare stocks. All these factors :

- Regulatory Changes: New laws, regulations, and policies can either positively or negatively impact the sector. For instance, changes in drug approval processes or healthcare funding can significantly affect pharmaceutical and biotechnology companies.

- Technological Advancements: Breakthroughs in medical technology can drive growth in the sector. Companies at the forefront of innovation often see substantial market gains.

- Demographic Shifts: An aging population increases demand for healthcare services and products, boosting the sector's growth potential.

- Economic Conditions: While generally resilient, the healthcare sector is not entirely immune to broader economic conditions. Economic downturns can impact funding and investment in healthcare, although the essential nature of healthcare services often provides a buffer.

Investment Strategies in Healthcare Stocks

Both long-term and short-term strategies offer benefits when investing in healthcare stocks:

Long-term investments capitalize on the sector's steady growth and resilience. They focus on companies with strong fundamentals, robust R&D pipelines, solid financials, and consistent product demand. Benefits include compounding returns and stability during economic downturns.

Short-term investments take advantage of market fluctuations, news events, and sector developments. They require understanding market trends, regulatory updates, and technological advancements.

They often involve biotech firms awaiting FDA approvals or medical device companies launching new products. Higher risk due to volatility and regulatory uncertainties.

Benefits and Risks Associated with Investing in Healthcare Stocks

Benefits are obvious for the aging population. Their constant need for medical advancements ensure sustained demand. Defensive investments during economic recessions, as medical care is always needed.

Risks are connected to regulatory changes that can impact stock performance. Success or failure of new product launches is critical. High R&D costs and lengthy regulatory approval processes add risk. They are sensitive to political and policy shifts, such as changes in healthcare funding or insurance regulations.

Monthly Dividend Stocks in Healthcare

Monthly dividend stocks are shares of companies that pay out dividends to their shareholders on a monthly basis, rather than the more common quarterly schedule.

These stocks are particularly attractive to investors who are seeking regular income, because they provide more frequent payouts. That helps to smooth out cash flow.

For investors, monthly dividend stocks offer several advantages. They provide a steady stream of income, which can be particularly beneficial for retirees or those relying on their investment portfolio for regular income.

Monthly dividends can be reinvested more frequently. They are potentially enhancing the compounding effect on the investment. In the healthcare sector, companies that offer monthly dividends often have stable cash flows and established business models. This is making them attractive for income-focused investors.

In the healthcare sector, there are three companies in this year’s monthly dividend stocks list that offer these kinds of stocks. These include:

- Extendicare Inc. (EXETF) provides a range of care and services for seniors across Canada. They are focused on long-term care and retirement living. Extendicare offers stable monthly dividends to its investors, and they are backed by the essential nature of its services and steady demand.

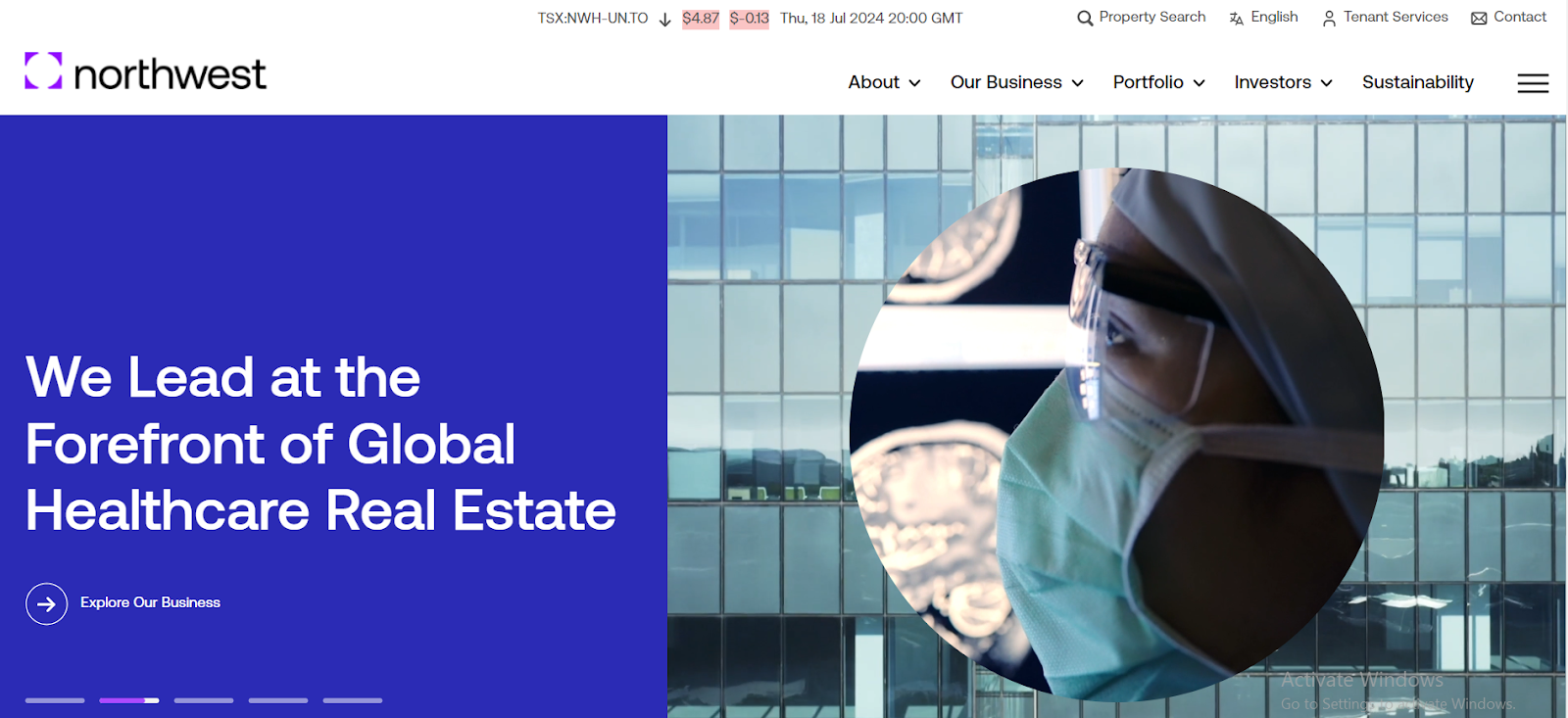

- NorthWest Healthcare Properties REIT (NWHUF) is a real estate investment trust that specializes in owning and managing healthcare properties. This includes hospitals, medical office buildings, and clinics across North America and internationally. The company's diversified portfolio and long-term leases contribute to its reliable monthly dividend payouts.

- Sienna Senior Living (LWSCF) operates senior living and long-term care residences in Canada. Sienna's extensive network of facilities provides comprehensive care services. They have consistent revenue streams that enable the company to offer regular monthly dividends to its shareholders.

The Road Ahead: Projections for Healthcare Stock Investments

Each and every investment on the stock market comes with a risk. If you invest wisely, the benefits are on the horizon, too. Healthcare stock investments have their own lane in the investment portfolio.

They are promising due to an aging global population. This creates increasing demand for chronic disease management. The older we get, the more likely we'll have to deal with some chronic disease or any other permanent state. And this is where all these companies with their products and services come in.

Technological advancements like personalized medicine, telehealth, and AI will drive new opportunities. This helps patients improve their quality of life, but also contribute to the investment portfolio of their stock owners. However, regulatory hurdles, high innovation costs, and data privacy issues pose challenges.

Despite this, growth and innovation potential remains strong. Investing in healthcare stocks and especially in the companies that pay monthly dividends, remains a smart investment. Making this choice means making the right choice, even more so if you use them to diversify your existing portfolio.