OpenTaxSolver is an Open-source Tax filling App for the USA Citizens

OpenTaxSolver (OTS) is a free, safe + secure program for calculating Tax Form entries for Federal and State personal income taxes. It automatically fills-out and prints your forms.

The project is regularly updated with new tax forms, regulations and updates.

The OpenTaxSolver (OTS) is created by Aston Roberts, several years ago who are still updating the app regularly.

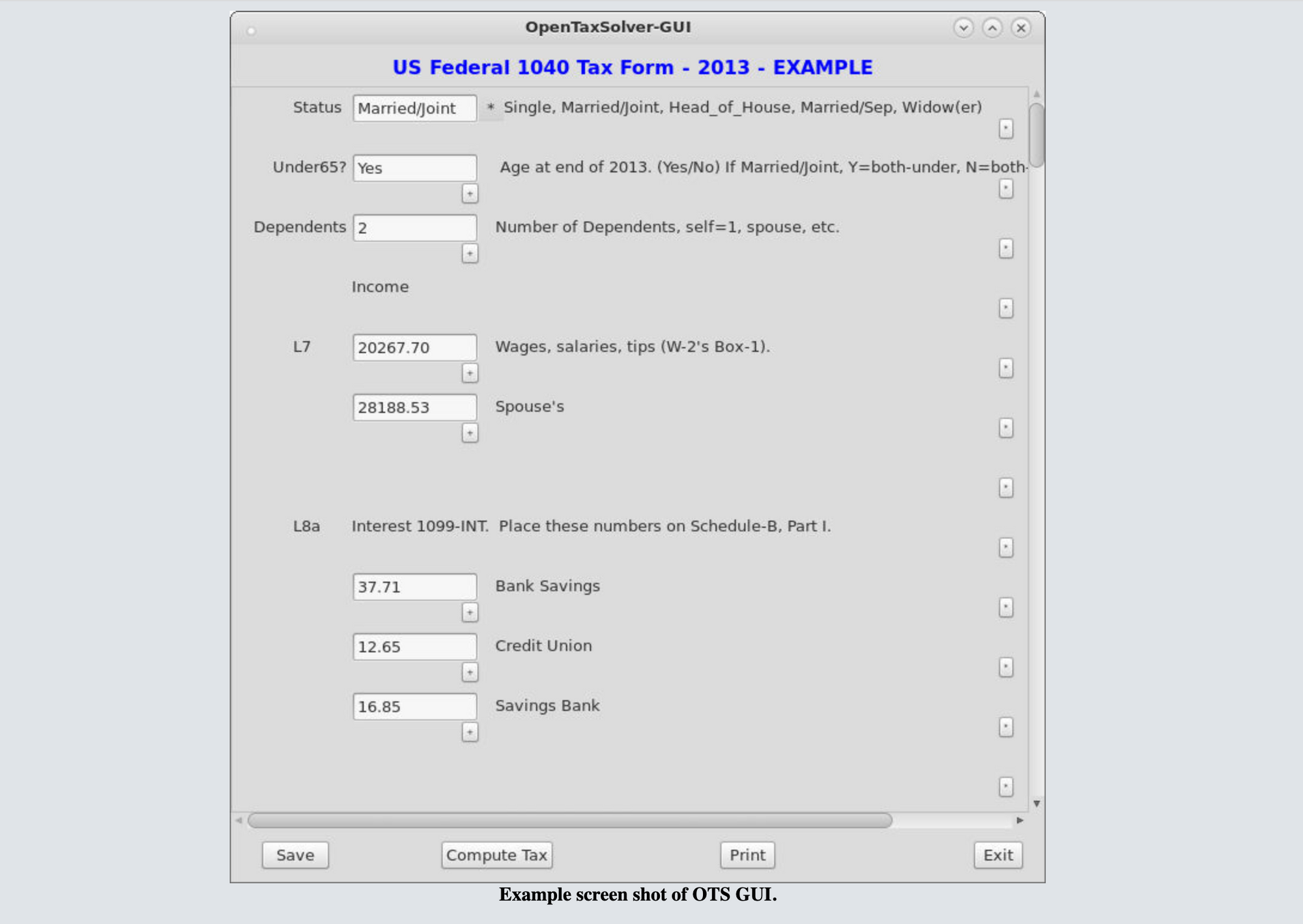

The OTS tax package is intended to be used with the Tax booklets published by your government for determining what numbers you need to enter, and then it assists you in doing the otherwise tedious calculations while showing the intermediate and final numbers. It takes care of the tedious and error-prone work.

OTS is intended for those who are comfortable doing their own taxes - especially those who have previously done their taxes and basically understand how to fill out the forms. OTS does much of the math for you.

What does it include?

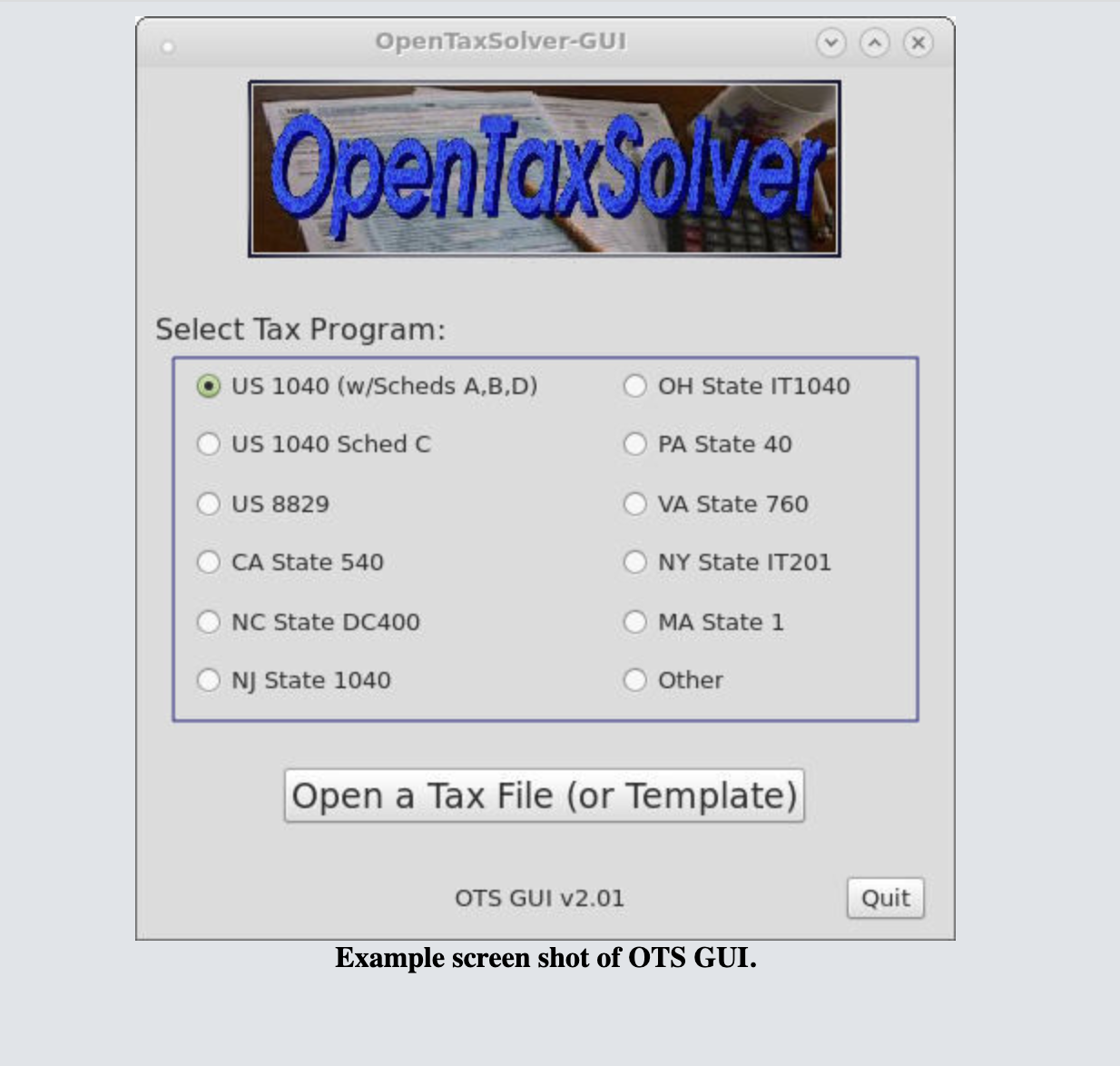

The OTS package includes the most used forms released by the IRS and several states, which are the

- Fed-1040, Schedules 1-3 along with Schedules A-D, and the states of VA, NC, OH, NJ, MA, PA, CA, and NY.

- As well as the Health Savings Account (HSA) Form 8889 and Form 8606 for Nondeductible IRAs, and Schedule-SE, which are accessed under the Other Forms bullet of the OTS GUI front screen.

- Several new forms have been contributed this year under the Other Forms bullet, including: Forms 2210, 8959, 8960, and California Form 5805.