Surprising 4 Tools You Might Want to Use When Dealing With Your Finances

Are You Truly Ready to Put Your Mobile or Web App to the Test?

Don`t just assume your app works—ensure it`s flawless, secure, and user-friendly with expert testing. 🚀

Why Third-Party Testing is Essential for Your Application and Website?We are ready to test, evaluate and report your app, ERP system, or customer/ patients workflow

With a detailed report about all findings

Contact us nowTable of Content

Finance management is a big topic in our age. And when you can comfortably get into debt without even noticing, it’s understandable. For example, borrowers were carrying around a shocking average credit card debt of $5,474 each in the third quarter of 2022 in the US.

Effectively handling your finances assumes a pivotal role in steering a path toward financial security and a life unburdened by financial worries. And not having a grip on your money can seriously crank up those stress levels.

So, let's spill the beans on a few financial tools you might not have stumbled upon yet. They could empower you to manage your finances and reduce anxiety when dealing with money-related issues.

Cloud Storage

The transition to digital storage isn't just about convenience; it's also about keeping your financial info snug as a bug in a rug, accessible wherever you are, and shielded from any unexpected hiccups along the way.

The good news is, the reliable digital storage providers out there take it seriously. They've got these nifty encryption techniques and access controls in place to make sure your data stays as safe as a bank vault.

And here's the cherry on top: disaster recovery. Imagine this – your data is floating around in the cloud, safe and sound. Even if your hardware decides to call it quits, or Mother Nature throws a tantrum in the form of fire or a tide to destroy your physical storage, your data remains untouchable online. It's like having a protective force field around your financial information, ready to fend off any physical damage or hardware mishaps.

To efficiently manage financial documents in the cloud, establish logical folder structures that mirror your financial categories. Implement clear file naming conventions that include dates and descriptions for easy retrieval. Regularly set up automatic backups to ensure continuous data protection.

Personal Finance Apps

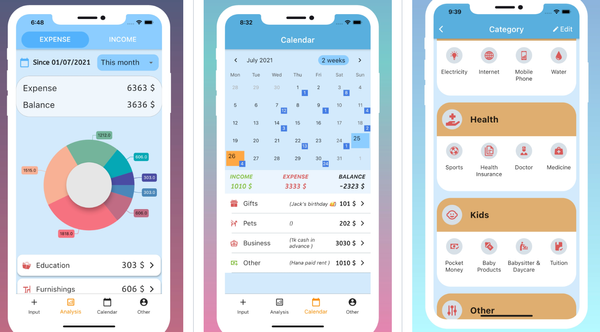

Wave goodbye to spreadsheet drudgery – personal finance apps have your back. They categorize expenses, sync transactions, and let you customize budgets. They're not just about money sorting; they're goal-getters, too.

Investment apps use algorithms for risk assessment and real-time market updates. Tax and retirement apps simplify filing and forecast financial needs.

Integrating these apps into one's financial routine involves configuring alerts and notifications for bill reminders and tracking progress. Regularly reviewing financial data within these apps allows users to make necessary budget adjustments and suggest ways to save.

Digital Receipt Organizers

In the pre-digital era, dealing with receipts could be quite a hassle. Many of us resorted to shoving paper receipts into various nooks and crannies – drawers, shoeboxes, or folders – which often resulted in chaos and frustration when we needed to locate a specific receipt or tally up our expenses for budgeting and tax-related purposes.

There’s a new way to keep track of your spending and save the planet at the same time: digital receipt organizers. They scan your paper receipts and turn them into digital files that you can store, sort, and access anytime, anywhere. Say goodbye to the clutter of physical copies and hello to a world where your receipts are neatly organized at your fingertips.

No more drowning in a sea of paper chaos. These tools automate expense tracking and turn tax reporting into a breeze. You'll have the upper hand when it comes to making those savvy financial choices.

Robo-Advisors

Robo-advisors, the digital architects of finance, operate autonomously with minimal human intervention, driven by intricate algorithms. They craft and oversee diversified investment portfolios, aligning them precisely with your financial goals and risk tolerance, championing objective, data-driven decisions over human intuition.

Robo-advisors, praised for cost-effectiveness, boast lower management fees compared to traditional advisors, boosting investor profits. Proficient at diversification, they strategically allocate investments across asset classes to reduce risk and maximize returns. Constantly vigilant, robo-advisors monitor portfolios 24/7, making proactive adjustments in shifting market conditions and keeping investments aligned with goals.

Considerations for choosing a robo-advisor include defining your financial goals and assessing risk tolerance, matching objectives with platforms. Compare fee structures for transparency and cost-effectiveness. Seek platforms offering personalization if you have specific preferences or ethical criteria. Evaluate customer support options, aligning them with your communication preferences.

Conclusion

Personal finance goes beyond just handling and investing your money. But the good news is, no matter where your bank account stands, you can give your dollars a little extra oomph. All it takes is a bit of savvy money management and steering clear of some common financial blunders. And these tools might just be your key to unlocking a world of savvy personal financial strategies.