The Midsize Bank's Guide for Effectively Screening Clients

Table of Content

One of the many ways that the COVID-19 pandemic has affected the banking industry is that it hastened the digital transformation of many midsized financial institutions. The circumstances demand that banks continue to provide their products and services while observing physical distancing and other health and safety protocols in the workplace. As such, many businesses made efforts to decentralize their operations by having their staff members use cloud-based systems and services, allowing them to collaborate despite the distance.

At the same time, many mid-size banks also took steps to accommodate online applications.

This makes their services more accessible to customers who are unable or unwilling to leave the comfort and safety of their homes.

There’s a downside to this, however. Financial criminals can take advantage of the situation to bypass the security checks that banks have put in place to screen high-risk individuals and entities.

Getting to know your customers through digital channels can be a complicated task if your financial institution is used to conducting face-to-face interviews with prospective clients.

On the other hand, upgrading your Customer Due Diligence (CDD) and Know Your Customer (KYC) protocols presents an opportunity to bring your institution into lockstep with modern banking practices. Let’s take a closer look at the steps that early adopters of digital transformation use for their KYC and CDD:

1- Identifying high-risk customers

From the get-go, a midsized bank should be looking out for individuals and entities that are associated with higher levels of risk. Some cursory research should reveal a few pertinent details that can lead to higher risk scores.

For example, businesses that are associated with a particular person, those that belong to a certain industry, or those that are based in countries that are known for conflict or corruption merit more detailed checking compared to other businesses or people that belong to low-risk industries and countries. These individuals or companies should be allocated higher risk scores and scrutinized more closely throughout the KYC and CDD process.

2- Checking a wide range of risk resources

There are many resources that you can use to compile information. These include commercial and open-source lists, internal and external whitelists and blacklists, and sanctions and prohibitions from various regulatory bodies and government agencies. Check these lists one-by-one and include any relevant information that you may find about the client you are investigating. In case the sources use non-Latin alphabets, try to convert it to a standard script that your investigation team and KYC and CDD solutions can understand and sift through.

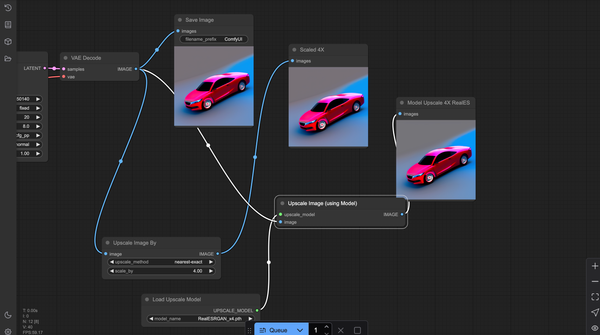

3- Preparing the data source

Preparing the data for a closer look at the customer is an essential part of the investigation. It’s safe to assume that the customer data has errors that can slow down the whole process. These discrepancies should be addressed immediately so that the investigation can continue easily. It would be prudent to check the client information for anomalies and accuracy, and to turn the data into a format that can be scrutinized properly. This way, the investigation team won’t have to pause occasionally to recheck vital information or convert the raw data into something that they can easily analyze.

4- Inexact matching

Aside from exact match searches, the investigation team should also carry out inexact or fuzzy matches. This type of search allows the team to find possible connections between misspelled words, missing data, and inaccurate information that may still be present in their sources. This helps ensure that your investigation team is not missing vital information and relationships between your existing and prospective customers.

5- Eliminating false positives

Your bank may be using multiple systems and solutions to run checks on your clients. Doing so can result in multiple false positives and duplicates, and combing through these manually can take up much of your team’s time. If this is the case, then your financial institution would benefit from newer KYC and CDD solutions that can effectively distinguish real risks from ones that produce repetitive search results or relationships that have been cleared in past checks.

A modern bank needs modern solutions to provide its clients with top-notch services, especially during these uncertain times. Investing in a new KYC and CDD solution may seem like a significant expense on paper, but it can significantly lighten the burden that your staff members have to bear, plus it can protect your company from hefty fines and penalties from regulatory bodies.

Thanks to a modern Know Your Customer and Customer Due Diligence service, your bank can reallocate resources to endeavors that will enable you to provide better services and products to your customers. This, in turn, will help your business thrive and make the most out of the opportunities presented by the challenges that we are all currently facing.

By: Bella Martin

Bella Martin is a content writer and marketing professional based in Manila, Philippines. She spends a lot of time studying how technology continues to transform lifestyles and communities. Outside the office, she keeps herself busy by staying up-to-date with the latest fashion trends and reading about the newest gadgets out on the market.