The Role Of Financial Planning In Effective Technology Procurement

Table of Content

In today’s rapidly evolving business environment, the intersection of financial planning and technology procurement is critical for organizational success. Companies are increasingly reliant on advanced technological tools and systems to remain competitive, streamline operations, and enhance productivity.

However, acquiring such technology necessitates substantial financial investment. Effective financial planning ensures that organizations can make these investments wisely, optimizing their technological capabilities without jeopardizing their financial health.

Read on to learn the role of financial planning in effective technology procurement.

Strategic Alignment Of Financial Planning And Technology Needs

Financial planning plays a pivotal role in aligning business goals with technology needs. By developing a comprehensive financial strategy, organizations can prioritize their technology investments based on their strategic objectives.

This alignment can help businesses to focus on immediate needs and consider long-term technological advancements. However, for more details on financing options that align with long-term business strategies, one might consider exploring options like credibly business loans.

Furthermore, companies looking to upgrade or expand their technological infrastructure could visit online resources for professional guidance and solutions tailored to their specific needs.

These resources can provide businesses with the necessary financial and technical insights to make informed decisions.

Budgeting For Technology Acquisition

Budgeting for technology acquisition is a critical facet of financial planning determining a company’s capacity to innovate and remain competitive. This process starts with a detailed analysis of the costs tied to the acquisition of new technologies, which includes initial purchase prices of hardware and software and expenses related to implementation, such as consultancy fees and integration costs.

Furthermore, it’s crucial to consider ongoing operational expenses covering maintenance, technical support, and regular upgrades. Effective budgeting ensures that these costs are forecasted and managed proactively. By allocating funds wisely and planning for unexpected expenses, companies can minimize financial risks and ensure that technological investments don’t destabilize their financial standing.

Risk Assessment And Management

Effective risk assessment and management are essential to the financial planning process, particularly in technology procurement. Companies must evaluate potential risks associated with new technologies, such as the rapid pace of technological obsolescence, the financial and operational stability of technology vendors, and the compatibility of new technologies with existing systems. By identifying these risks early, businesses can devise strategies to mitigate them, including setting aside contingency funds, investing in appropriate insurance products, and engaging in thorough due diligence of vendors.

Additionally, understanding these risks aids in negotiating better contract terms that include favorable conditions such as warranties, support, and scalable solutions. This comprehensive approach to risk management protects the company’s investments and ensures smoother technological integration and operation.

Cost-Benefit Analysis

A cost-benefit analysis is a critical component of financial planning for technology procurement, serving as a decision-making tool to evaluate the potential returns on technology investments. This analysis can help organizations determine the feasibility and profitability of adopting new technology by quantifying both tangible and intangible benefits. These include:

- Increased Efficiency: It measures improvements in process speed and reduction in labor requirements.

- Cost Savings: It identifies direct savings from reduced operational costs and indirect savings from minimized downtime.

- Improved Customer Satisfaction: It assesses enhancements in service delivery that may lead to higher customer retention rates.

- Innovation: It evaluates the potential for new technology to contribute to product or service innovation, providing a competitive edge.

By thoroughly analyzing these factors, businesses can make informed decisions on whether the technological investments align with their strategic objectives and yield sufficient financial returns to justify the initial and ongoing investment costs.

Financing Options For Technology Investments

Choosing the most suitable financing option is crucial for managing the financial impact of technology investments. Organizations must consider their current financial health and strategic objectives when selecting from the available financing methods. Some primary financing options include:

- Leasing: This enables businesses to use the latest technology without committing large capital expenditures upfront. Some benefits include lower initial costs, tax advantages, and easier upgrades.

- Loans: These can provide a lump sum of capital with a fixed or variable interest rate, suitable for businesses that prefer ownership and can manage regular repayment schedules.

- Venture Capital: This offers significant funding for high-growth potential companies, typically in exchange for equity. This is ideal for startups and tech companies with innovative projects but limited access to traditional financing.

Each financing method has unique advantages and financial implications, such as impacts on cash flow, tax benefits, and balance sheet appearances. Businesses must thoroughly evaluate each option to select the one that best supports their technological and financial goals.

Impact Of Technological Advancements On Financial Planning

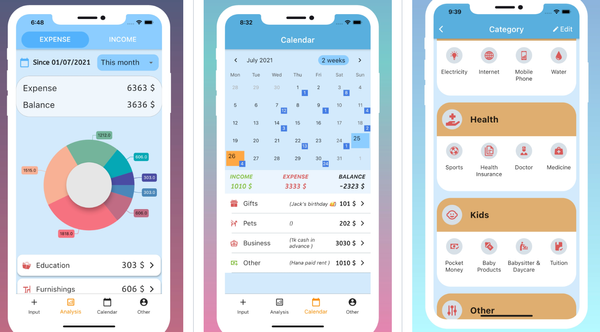

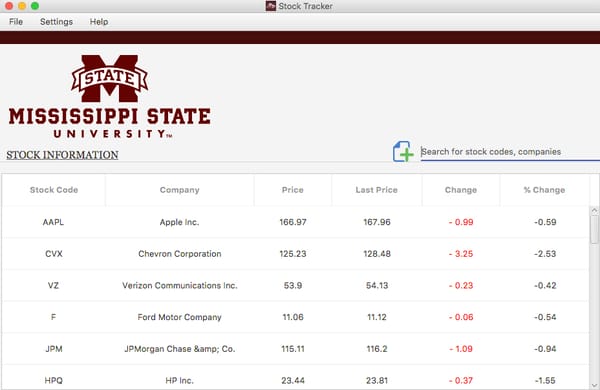

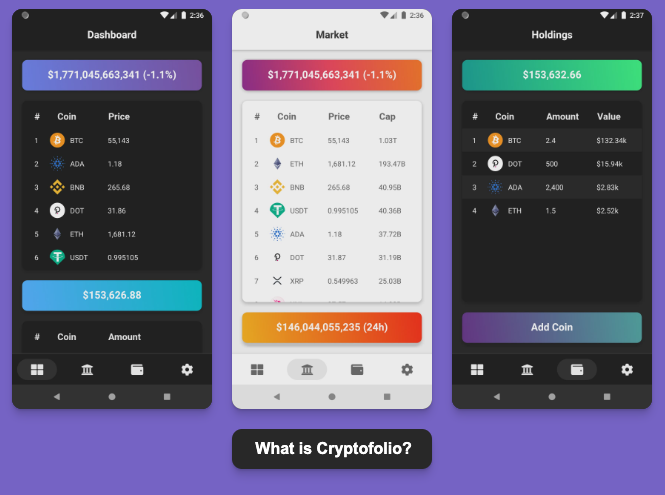

Technological advancements have significantly transformed financial planning, introducing efficiencies and capabilities that were previously unattainable. Modern financial tools and software have revolutionized several aspects of financial management. These tools include:

- Accurate Forecasting: Advanced algorithms and data analytics can provide precise revenue and expense forecasts, helping businesses more effectively plan for future growth and budgetary needs.

- Real-Time Budget Monitoring: Technologies such as cloud computing allow for the real-time tracking of financial activities against budgets, ensuring that deviations are quickly identified and addressed.

- Improved Financial Reporting: Automation tools can streamline the creation of financial reports, reducing human error and enhancing the speed and accuracy of financial statements.

- Deeper Insights: Integrated financial systems offer comprehensive analytics that reveal patterns and trends, supporting strategic decision-making.

These technological tools enhance the efficiency of financial operations and empower finance teams to play a more strategic role in business planning and management.

Training And Development

Integrating new technology within a business necessitates a parallel investment in training and development to maximize its benefits. Proper training is crucial for ensuring that employees can effectively utilize new tools, boosting productivity and engagement. Some key considerations for incorporating training and development into financial planning include:

- Assessment of Training Needs: Identify the specific skills and knowledge gaps that training programs must address.

- Customized Training Programs: Develop or source training initiatives tailored to the unique requirements of the technology and the users’ proficiency levels.

- Cost Planning: Allocate adequate resources in the financial plan for training, which may include external trainers, online courses, and time off for employee learning.

- Ongoing Support and Upgrades: Ensure continuous education and support to keep pace with technology updates and changes.

By incorporating these elements into the financial planning process, businesses can ensure that investments in technology are fully leveraged, thereby enhancing the overall productivity and competitiveness of the business.

Final Thoughts

The role of financial planning in effective technology procurement can’t be overstated. It ensures that technology investments are made judiciously, aligning with the company’s strategic goals and financial constraints. By keeping the information mentioned above in mind, businesses can enhance their technological capabilities while maintaining financial stability. Ultimately, the synergy between financial planning and technology procurement is pivotal in driving business growth and innovation in the digital age.