10 Open-source Tax Management Solutions

Table of Content

Tax management software is a type of software solution designed to help businesses and individuals manage their tax-related tasks. Tax management software can help automate the process of filing taxes, managing tax documents, and tracking tax-related expenses.

Benefits of Tax Management Software

There are several benefits of using tax management software. Some of these include:

- Accuracy: Tax management software can help reduce the risk of errors by automating calculations and providing real-time updates on tax-related information.

- Efficiency: Tax management software can help streamline the tax-filing process, saving time and effort for businesses and individuals.

- Cost-effective: Tax management software typically costs less than hiring a tax professional to manage tax-related tasks.

- Customizable: Tax management software can be customized to meet the specific needs of businesses and individuals, making it a versatile solution for tax-related tasks.

Challenges of Tax Management Software

While tax management software can be a valuable tool for businesses and individuals, there are also some challenges to using this type of software. Some of these include:

- Learning curve: Tax management software can be complex and may require some time and effort to learn how to use effectively.

- Maintenance: Tax management software may require updates and maintenance to remain up-to-date and effective.

- Security: Tax management software may contain sensitive financial information, so it is important to ensure that the software is secure and protected against potential threats.

Overall, tax management software can be a valuable tool for businesses and individuals looking to manage their tax-related tasks more efficiently and accurately. By weighing the benefits and challenges of this type of software, users can make an informed decision about whether tax management software is right for their needs.

This post provides a list of open-source tax management software that primarily caters to US subjects.

1- Taxation

Taxation is an open-source tax and library for PHP projects aiming to help developers in tax calculation and processing. Taxation is a part of Sylius, an open-source headless eCommerce solution.

Taxation supports multiple items, zones, and different tax rates.

2- OpenTaxSolver (OTS)

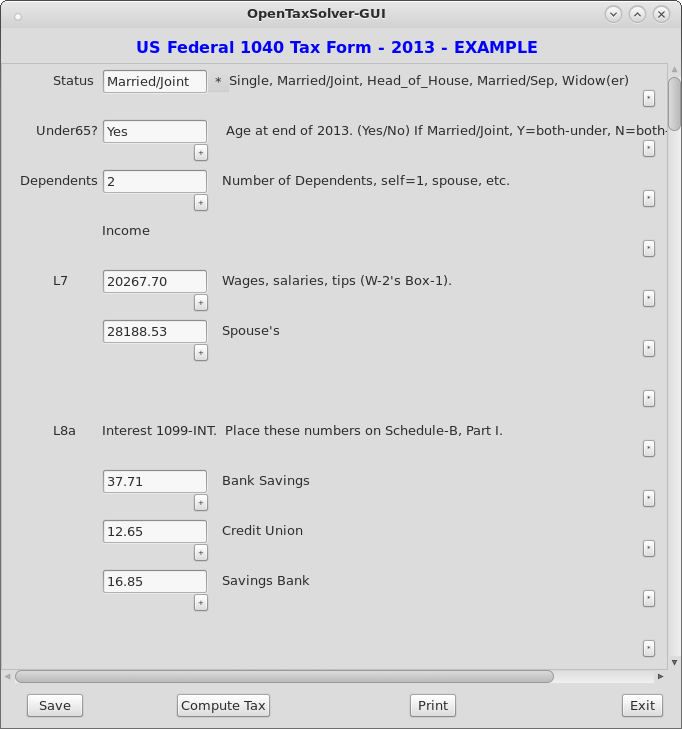

OpenTaxSolver (OTS), is a free, tax calculator designed for individuals, companies, freelancers to help in their Federal and State personal income taxes.

OpenTaxSolver comes with autofill out feature, US-specific tax calculator, a simple GUI without any hidden tricks, and supports varies US tax forms.

OpenTaxSolver is getting a new release every year to match with the new requirement in the US. So, if you are a US citizen, then this app is for you.

3- GST Tax Management System

The GST Tax Management System is an easy-to-use accounting and invoicing software that aims to cater to the specific requirements of various business organizations for tracking GST tax. GST Software is a business system that lets taxpayers manage GST compliance. GST is a technological tax form that has almost all the models handled online.

4- UsTaxes

UsTaxes is a free, web-based, and open-source tax filling application that supports Federal 1040 form. https://ustaxes.org/start

Supported Income data

Most income and deduction information from the following forms are supported for tax years 2020 and 2021.

- W2

- 1099-INT

- 1099-DIV

- 1099-B

- 1098-E

- 1099-R: support for normal distributions from IRA and pension accounts.

- SSA-1099

So far, this project can attach the following schedules to form 1040:

- Schedule 1 (as to Schedule E and 1098-E data only)

- Schedule 3 (as to excess FICA tax only)

- Schedule 8812

- Schedule B

- Schedule D

- Schedule E

The app can be installed easily by using Docker and Docker-compose, all is required to clone the repo and run:

docker-compose build

docker-compose upIf you want to run it as a desktop application, you need Node.js and NPM installed on your machine, Rust, and Cargo (Rust package manager).

By then you run run the desktop edition by running this command from the cloned repo.

npm run desktop 5- PayTax

PayTax is an open-source free Tax management system built with PHP. However, it is not updated since 10 years.

6- Tax PHP library

The tax library is a PHP 5.5+ tax management library for PHP projects. It supports several tax data models, and tax zones for US, Canada, EU, and several other countries.

The library is built to help developers include a tax resolver and calculator in their apps quickly, it is not meant for the end-user.

7- Tax-Calculator

Tax-Calculator is an open-source micro-simulation model for static analysis of the USA federal income and payroll taxes.

It is intended for developers, and people who know their way around the code. It can be installed through Anaconda package manager:

conda install -c conda-forge taxcalc

8- Income Tax Calculator

Income Tax Calculator is a free, open-source desktop tax calculator and tax filing application for individuals and small business owners in India.

It offers a simple user-interface with a virtual keyboard support, tax schemes, user details filling, a built-in tax calculator, and a PDF report generation.

9- Tax-Calculator

Tax-Calculator is an open-source micro-simulation model for static analysis of the USA federal income and payroll taxes. You can install it with Anaconda via:

conda install -c conda-forge taxcalc

When using micro data that represent the USA population, Tax-Calculator can estimate the aggregate revenue and distributional effects of tax reforms under static analysis assumptions.

Tax-Calculator can also process custom-created data on one or more filing units permitting analysis of how tax reforms affect certain people.

Tax-Calculator interacts with other models in the Policy Simulation Library to conduct non-static analysis.

10- py1040

This is a tax calculator for one individual U.S. tax return—Internal Revenue Service form 1040.

More resources

- https://smartasset.com/taxes/income-taxes

- https://www.irs.gov/individuals/tax-withholding-estimator

- https://github.com/gsugar87/CryptoTaxes

- https://github.com/ShreyasSubhedar/Tax-Automation

- https://www.freefilefillableforms.com/#/fd