UsTaxes is an open-source free tax filing app for the USA

Table of Content

What is UsTaxes?

UsTaxes is a free, open-source tax filing application that can be used to file the Federal 1040 form. It is available in both web and desktop versions. It is provided free of charge and requires no sharing of personal data.

Interested in contributing? Get Started

Supported Income data

Most income and deduction information from the following forms are supported for tax years 2020 and 2021.

- W2

- 1099-INT

- 1099-DIV

- 1099-B

- 1098-E

- 1099-R: support for normal distributions from IRA and pension accounts.

- SSA-1099

So far, this project can attach the following schedules to form 1040:

- Schedule 1 (as to Schedule E and 1098-E data only)

- Schedule 2

- Schedule 3 (as to excess FICA tax only)

- Schedule 8812

- Schedule B

- Schedule D

- Schedule E

- F1040-V

- F8949 (Uncovered Investment Transactions)

- F8889 (Health Savings Accounts)

- F8959 (Additional Medicare Tax)

- F8960 (Net Investment Income Tax)

Supported Credits

- Credit for children and other dependents

- Earned income credit

Supported states

Implemented State returns

The states below have been implemented partially. See the /src/stateForms/<state>/<relevant form> file for details on unimplemented portions.

- Illinois

Non-filing states

Users who only have wage income and live in the states below should be able to file taxes using this site, since they do not have state level income tax.

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Note on using this project

This project is built by a growing community. If you notice an error in the outputted PDF or any other error, please submit an issue on the Github issues tab. We appreciate your feedback!

User Data

The project is available strictly via client side. Data is persisted to the site's localstorage so no personal information ever leaves the user's computer. For those who want extra security, the codebase can also be built as a desktop application.

Contributing

Thank you for taking the time to contribute; let's make tax filing free for everyone! 🎉

To ensure the project is fun for every contributor, please review:

Get Started

This application can be run as either a web application or a standalone desktop application

Web application

This project runs on Node 16. To ensure you're on the proper version, we recommend nvm.

With nvm installed, you may select a version 16 node using:

nvm install 16

nvm use 16

To run,

npm ci # install package dependencies

npm run start # run app

Note: To avoid having to set your node versions, we suggest using a tool like direnv. With the following configuration file as .envrc in project root:

export NVM_DIR="$HOME/.nvm"

. "$NVM_DIR/nvm.sh" # This loads nvm

#. "$NVM_DIR/bash_completion" # Optional, nvm bash completion

nvm install 16

nvm use 16

your environment will be set up every time you enter the project directory.

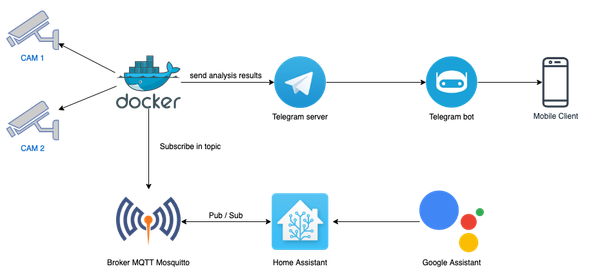

Docker

If preferred, a Docker alternative is available:

docker-compose build

docker-compose up

Open a browser to http://localhost:3000.

To stop and remove running containers, run docker-compose down.

Desktop application

The desktop application is built with Tauri. In addition to the above steps, please follow this reference for setting up your environment for Tauri.

Once your environment is set up for Tauri, run, npm run desktop. To avoid a browser window being spawned in addition to the desktop window, just set the BROWSER environment variable as in: BROWSER=none npm run desktop.

To build executables, run npm run desktop-release.

Getting help

Please reach out to us on our discord if you run into any problems, or file an issue. Thank you for your support!